Select Your New Lincoln

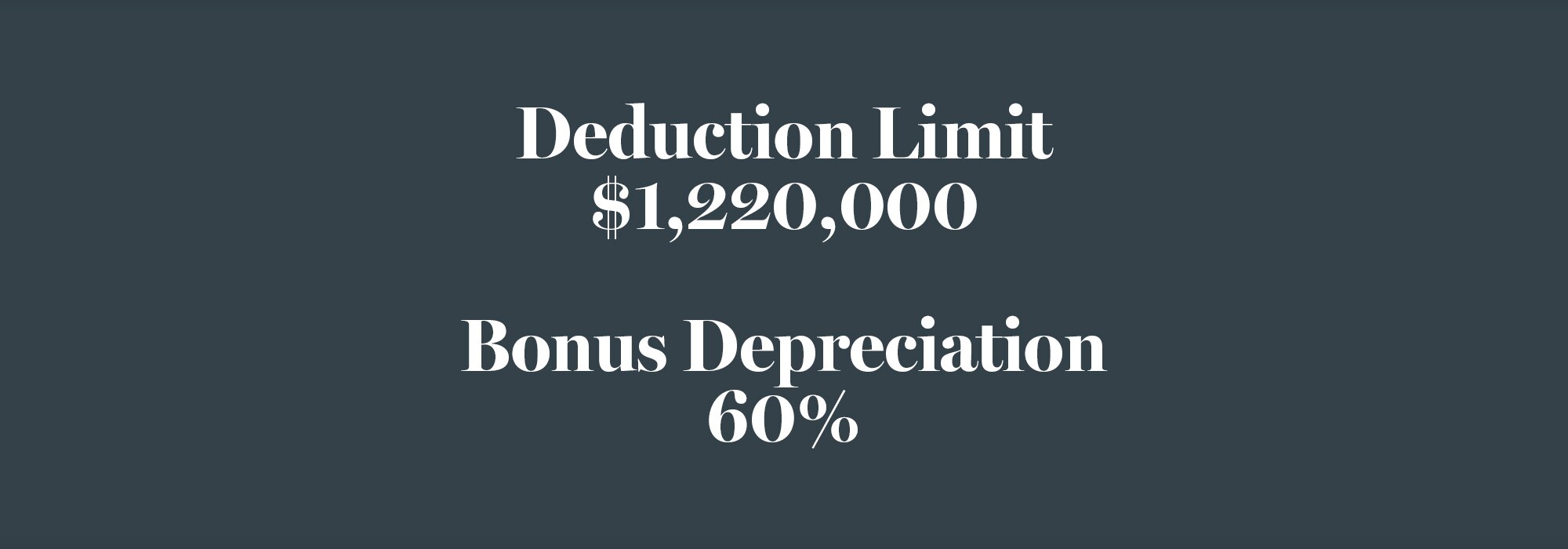

High-quality performance is non-negotiable if you're running a successful business. Apple Lincoln welcomes fellow business owners seeking a new Lincoln for sale in Columbia, MD, to enjoy massive tax savings with the Section 179 tax deduction. Purchase a new commercial vehicle without restricting yourself to a budget with a deduction limit of up to $1,220,000 and a purchase limit of $3,050,000 during a tax year, per the Internal Revenue Service (IRS).* To qualify for Section 179 tax savings, eligible commercial Lincoln vehicles must be used for commercial purposes more than 50% of the time. Learn how to save on a new Lincoln with the Section 179 tax deduction at Apple Lincoln in Columbia, MD.

Eligible Lincoln Vehicles

Offer your valued customers elevated comfort, efficiency, and versatility inside a new Section 179 eligible Lincoln. Find several bestselling models at your disposal for the best fit, including the Lincoln Navigator (2WD and 4WD), the Lincoln Navigator L (2WD and 4WD), and the Lincoln Aviator (RWD and AWD.) Select the configuration that best suits your needs and budget and enjoy other advantages, such as an 60% bonus depreciation for new commercial Lincoln vehicles purchased through the Section 179 tax deduction in Maryland.

Get Started

Growing your business is easy alongside a new Lincoln. Visit Apple Lincoln to learn more about the advantages of the Section 179 tax deduction.